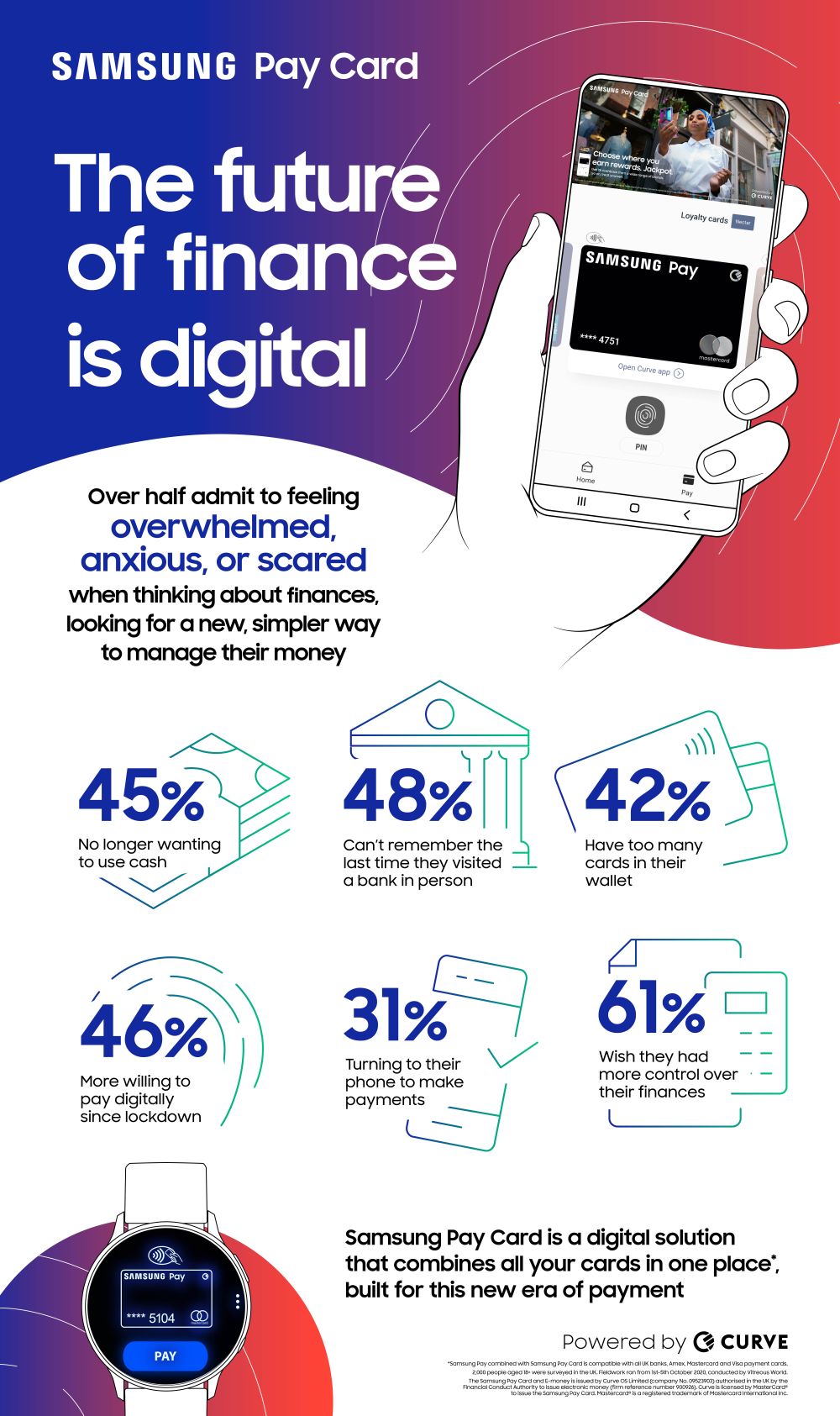

An increasing number of people in the UK are more willing to rely on digital payment solutions rather than cash, and more than 50% of Brits are looking for newer, simpler ways of managing their finances. This is according to a recent survey commissioned by Samsung Pay, revealing that the COVID-19 lockdown period was one of the main driving forces behind this shift in consumer mentality.

According to the survey, 46% of Brits are more willing to perform digital payments now than they were before the COVID-19 lockdown period. Likewise, 42% of survey participants claim to have too many cards in their wallets and 45% are looking for ways to avoid using cash. 31% of Brits are now reportedly making payments using mobile payment solutions, and of course, this is good news for Samsung Pay.

70% of people living in the UK want a unified payment solution

One of the biggest advantages offered by Samsung Pay is that it can bring all the user’s cards and bank accounts together in one easy-to-manage place, i.e., the mobile Samsung Pay mobile wallet. The survey reveals seven in ten people believe that such a unified solution is a game changer.

Not only is Samsung Pay making finance managing easier but the platform rewards customers through various programs. And with the Go Back in Time functionality, customers are able to retroactively move transactions between different cards. Samsung Pay was released in the UK in August in collaboration with Curve.

The post UK’s future of finance is digital and Samsung Pay is helping the transition appeared first on SamMobile.

from SamMobile https://ift.tt/2I0elwd

via IFTTT

ليست هناك تعليقات:

إرسال تعليق